What Does a Home Warranty Cover?

Key takeaways:

-

The home warranty industry is expanding, valued at $3.9 billion in 2023. Coverage usually includes maintenance, repair, and replacement of home appliances and systems but varies by plan and provider

-

Home warranty offerings differ among providers, with factors like state regulations and local repair costs affecting coverage. For instance, Cinch Home Services provides three main plans with different coverage scopes.

-

Home warranties have exclusions, typically not covering pre-existing conditions, secondary damages, incidental costs, structural parts of the home, outdoor items, and minor appliances.

-

Home warranties are distinct from manufacturers' warranties and homeowners insurance, mainly focusing on covering a range of home appliances and systems irrespective of age or brand.

According to internet research firm Ibis World, the home warranty business in the U.S. has grown at an average annual rate of 3.4% between 2018 and 2023. Estimates put the current market size at $3.9 billion. These numbers show that homeowners are increasingly drawn to a home warranty's financial benefits and peace of mind. For those interested in a home warranty but wondering what a home warranty covers, let's now explore in finer detail.

What a home warranty covers, in a nutshell

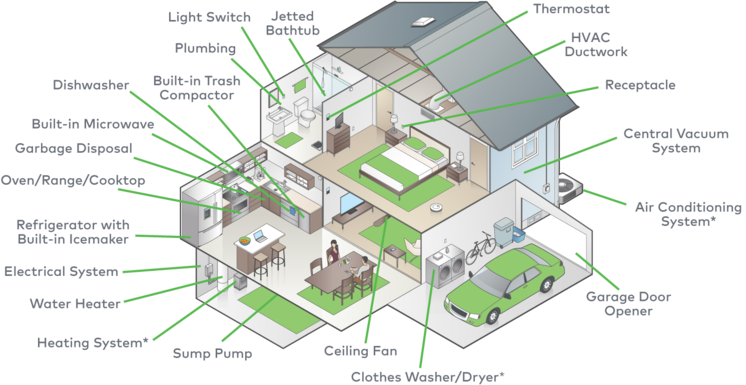

A home warranty covers the cost of maintenance, repair and replacement of major appliances and systems inside your home. Coverage of individual systems and appliances varies with the particular service provider and the plan you choose. However, the National Home Service Contract Association (NHSCA) does mention some standard inclusions of systems and appliances on its website.

Different Home Warranty Plans Have Different Coverage

Different home warranty plans vary by provider, with each company offering different coverage options and pricing. Additionally, the state and location of your home can also play a role in what type of coverage is available to you. Some states may have specific regulations that impact what can be covered under a specific plan, while location can also affect the cost of home warranty coverage due to varying local repair and labor costs.

At Cinch Home Services, we mainly offer three different plans to our customers:

- Appliance coverage plan

- Built-in systems coverage plan

- Complete home warranty plan

Home warranty appliance coverage

A Cinch Home Services Appliances plan warranty offers comprehensive coverage on a range of key appliances. Depending on the plan you choose and the additional coverage and add-on benefits you wish to purchase, you can cover some or all of the following appliances:

Kitchen appliances

- Dishwashers

- Refrigerators

- Built-in microwaves

- Cooking ranges

- Cooking range exhaust hoods

- Wall ovens

- Cooktops

- Trash compactors

- Freestanding ice makers

- Freestanding freezers

- Built-in food centers

Laundry appliances

- Clothes washers

- Clothes dryers

Other appliances

- Swimming pools

- Spas

- Well pumps

- Water softeners

- Garbage disposals

- Smoke detectors

A maximum of two units of each of these appliances are covered under a Cinch home warranty.

Home warranty built-in systems coverage

Cinch plans are ideal for protecting yourself against the costs of maintenance, unexpected repairs and replacement of built-in home systems. Once again, coverage of individual systems depends on your choice of plan. Here’s how coverage breaks down into categories for the Built-in Systems plan:

Cooling and heating systems

- Central air electric splits and mini splits

- Cooling and heating geothermal units

- Cooling and heating package units

- Electric baseboards

- Floor furnaces

- Forced air (gas, electric, oil) units

- Heating mini splits

- Heat pumps

- Hot-water or steam-circulation heaters

- Wall-mounted air-conditioning units and heaters

Electrical systems

- Built-in attic, exhaust and vent fans

- Battery-operated and hard-wired smoke detectors

- Ceiling fans

- Central vacuums

- Direct current wiring and light fixtures

- Doorbells

- Garage door openers

Plumbing systems

- Drain and sewer stoppages

- Garbage disposals

- Instant hot/cold water dispensers

- Permanently installed sump pumps

- Plumbing valves, lines and other components

- Standard and tankless water heaters

- Toilets

- Built-in whirlpool/jetted tub motors, pumps and air-switch assemblies

Refer to our sample agreement for further details on the extent of coverage on built-in systems, exclusions, and detailed terms and conditions.

Complete home warranty coverage

A Cinch Complete Home warranty plan offers you the best of both worlds in one package: protection for your appliances and built-in systems. One of the most popular plans among our offerings, the complete home warranty plan offers total peace of mind.

Besides covering the extensive list of appliances and built-in systems described above, the complete home warranty also provides a homeowners insurance deductible reimbursement of up to $500.

Another attractive benefit of all Cinch home warranties is they also cover unknown pre-existing conditions.

Understanding what exactly coverage means for different appliances and your home

Now that we know what certain home warranty plans can cover, you might be wondering what coverage really means for each appliance, and how it is different from homeowners insurance. We’ve made it easy for you to explore each appliance or part of your home and understand what coverage really means under most plans. Click on the links bellow to find out more.

What’s not covered by a home warranty?

A Cinch Home Services warranty offers comprehensive coverage on a wide range of critical built-in systems and home appliances. However, there are exceptions to home warranty coverage that typically fall within the following categories:

- Pre-existing conditions. These refer to mechanical or system failures caused by normal wear and tear, lack of due maintenance, faulty installation or aftermarket modification. Sometimes pre-existing conditions can be passed on to homebuyers by previous owners or result from prolonged absence from home. A skilled home inspection professional can identify most pre-existing conditions before you sign a home warranty contract. Any issues not revealed by visual or mechanical inspection methods are classified as “unknown pre-existing conditions” and automatically covered under Cinch home warranties.

- Secondary damages. These are damages caused by a breakdown or malfunction in a home appliance or built-in system. For instance, if a plumbing pipe bursts and floods your basement, a home warranty will cover the cost of replacing the damaged pipe as long as your plan includes plumbing systems. However, the secondary damages caused as a result of the flooding will not be covered under the home warranty plan. Your home insurance plan is more likely to cover these costs.

- Incidental costs. Incidental costs are those incurred during the process of repairing or servicing an appliance or system, but they’re not directly related to that event. For instance, the cost of excavating a portion of the floor to get access to the septic system is incidental. These costs include expenses related to disposing of old equipment and modifying new equipment to make the existing system work.

- Structural components. These include your house foundation, walls, doors, windows, roof leaks, gables, attics and so on, which are not covered by a Cinch warranty plan.

- Appliances and systems outside the house. These include your gate, driveway, yard and garden, garage, outhouse, patio, sprinkler systems and other outdoor features, which are not covered by a Cinch warranty plan.

- Minor systems and appliances. A home warranty does not cover your home theater system, electric kettle, air purifier, and other similar items.

A home warranty doesn't cover the same things a homeowners insurance does

Let’s see how home warranties work by first differentiating them from two terms they’re often confused with: a manufacturer’s warranty and a homeowners insurance policy.

A manufacturer’s warranty covers the cost of service, repair or replacement of a specific appliance or system for a limited time after purchase. Homeowners insurance offers comprehensive protection against losses to your home due to natural disasters like floods and earthquakes, accidents like fire and smoke damage, and incidents like theft and burglary.

A home warranty, on the other hand, is a service contract that covers the cost of maintenance, repair and replacement of important home appliances and built-in home systems. Appliances and systems are covered irrespective of the particular brand or how old the appliance or system is. Although there can be circumstances of overlap between the three services, they remain distinct for the most part.

Is there a difference in coverage for a buyer and seller when purchasing a home?

It depends on the situation. In most cases, the coverage depends on the provider and other factors mentioned above. Who pays for the warranty is down to negotiations between the buyer and seller, or the real estate agent.

In some cases, real estate agents get home warranties on listings that stay on the market longer, and they might be able to get better offers when purchasing a home warranty. If agreed, they can transfer that warranty to the new owner.

How do home warranties work?

Here are two instances where a home warranty comes into play.

Let’s say you notice a disturbing damp smudge forming on your living room ceiling. What started as a small spot soon grows to a size that you cannot ignore any longer. You call in a general contractor to diagnose the problem, and after a few hours of looking into things, you get bad news. A water pipe in your second-floor bathroom is leaking. As long as it’s a small section of one pipe that needs replacing, you can fix it for as little as $300.

However, what if workers discover lead pipes (which the law requires you to replace) or find multiple problems with the plumbing system across your home? You’ll be looking at a massive bill for thousands of dollars in plumbing replacements. That’s not including the cost of digging up cement-encased pipes and redoing walls and floors damaged in the process. You’ll need to pay only a fraction of this cost as long as you have a home warranty plan that covers plumbing systems.

Consider another situation. You’ve just been informed that a breakdown in your HVAC system is irreparable, and the entire system needs to be replaced. The average cost of a new HVAC system is $7,000, ranging from $5,000 to $10,000. If you live in a 2,000-square-foot home, ductwork and installation alone will cost you another $7,000 to $8,000. In other words, replacing your HVAC system will cost a minor fortune in out-of-pocket expenses. But this won’t be the case if you have a home warranty for built-in systems. As long as the home warranty covers your HVAC, it will take care of the full replacement cost, with you liable to pay no more than a small service fee.

Home warranty coverage FAQs

Even though we’ve discussed the coverage limits of home warranties in detail, you may still have questions. Let’s address some of the questions people frequently ask:

Do home warranties cover things that are already broken?

Things that were already broken before you signed a home warranty contract will be excluded from your plan after due inspections. However, you can fix broken systems and appliances before purchasing a Cinch home warranty. Any subsequent malfunctions and breakdowns of included items will be covered from the moment the warranty kicks in.

Do home warranties cover anything outside your home?

Home warranties typically do not cover any appliance or system outside your home. Elements like CCTV and other security systems, yard maintenance systems like sprinklers, and other components in your driveway, yard or garden are outside the purview of home warranty contracts.

Do home warranties cover structural aspects of your home?

Home warranty plans do not cover structural elements like foundations, walls, doors, windows, attics and roofs.

Are home warranties worth it?

As long as you choose the right plan from a reliable home warranty company, home warranties are worth every penny. Most people lack the skills or experience required to fix the complicated electronic and mechanical systems we have in our homes. The cost benefits of blanket coverage on the maintenance, repair and replacement of critical home appliances and built-in systems are often too good to pass up.

Instead of spending anywhere from $50 to $500 per service call on minor issues and thousands of dollars on major ones, it's wise to pay an affordable monthly premium on home warranty costs.

Discover the best home warranty for your needs

Cinch Home Services is a trusted home warranty provider for millions of American homes across several states. Our award-winning service is backed up by an elite team of technicians and service professionals.

We have tailor-made coverage options to include a wide range of major home appliances and built-in home systems. Or maybe you’d like to buy complete peace of mind with our home protection plan that covers all vital assets inside your home. Whatever your choice, our competitive pricing means signing up with Cinch is an investment that gives back throughout the years.

The information in this blog library is intended to provide general guidance on home warranties, and on the proper maintenance and care of systems and appliances in the home. Not all of the topics mentioned are covered by our home warranty or maintenance plans. Please review your home warranty contract carefully to understand your coverage.

Our blog library may link to third-party sites that offer products, services, coaches, consultants, and/or experts. Any such link is provided for reference only and not intended as an endorsement or statement that the information provided by the other party is accurate. We are not compensated for any products or services purchased from these third-party links.

The information in this blog library is intended to provide general guidance on home warranties, and on the proper maintenance and care of systems and appliances in the home. Not all of the topics mentioned are covered by our home warranty or maintenance plans. Please review your home warranty contract carefully to understand your coverage.The information in this blog library is intended to provide general guidance on home warranties, and on the proper maintenance and care of systems and appliances in the home. Not all of the topics mentioned are covered by our home warranty or maintenance plans. Please review your home warranty contract carefully to understand your coverage.

Take an in-depth look at the home appliances and built-in systems covered by a home warranty contract, conditions for coverage, and other key details.