How does coffee consumption in America look today? [Study]

Key takeaways

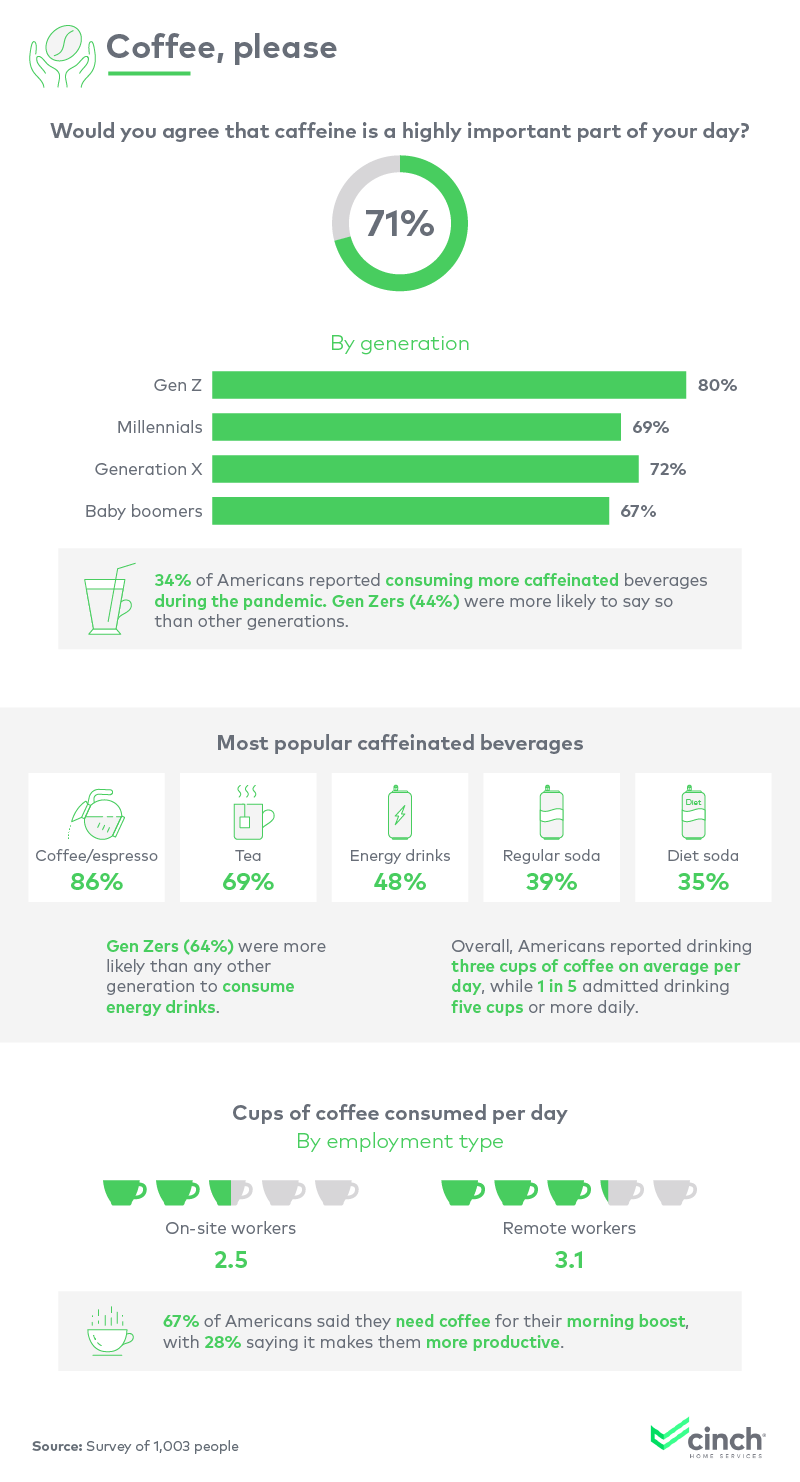

- Gen Zers (80%) found coffee more important to their day than any other generation

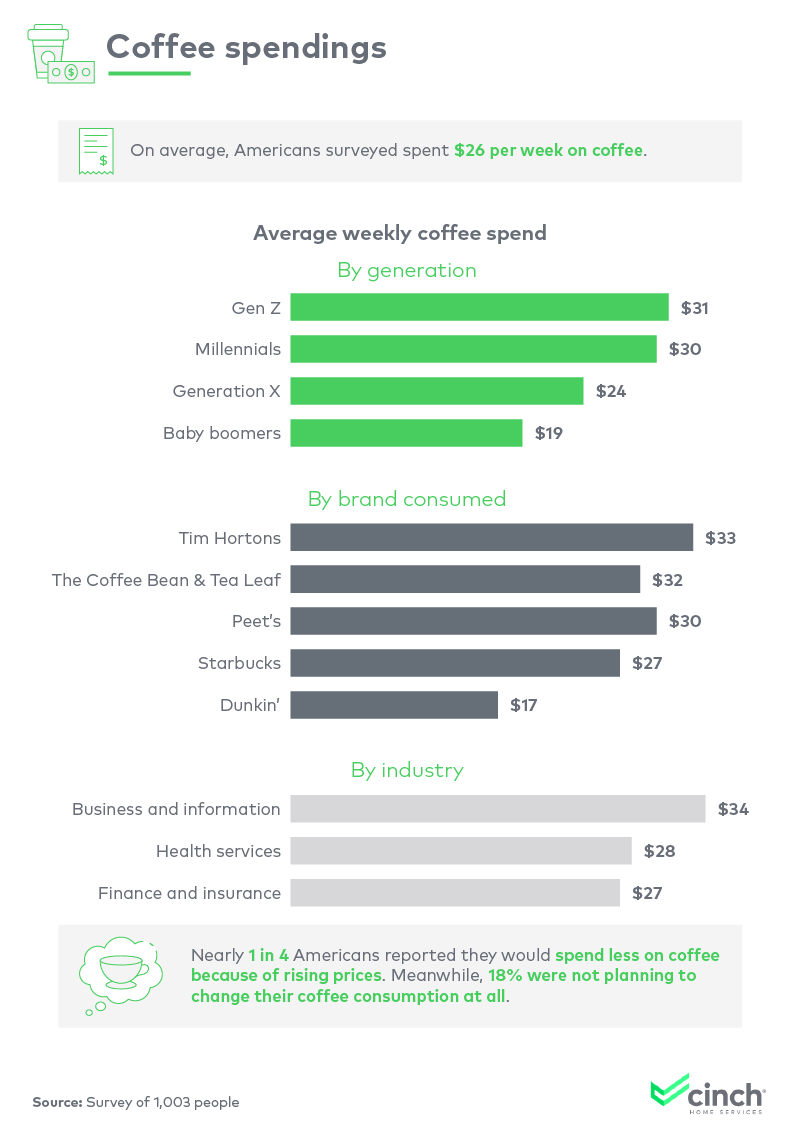

- On average, Americans spent $26 on coffee per week

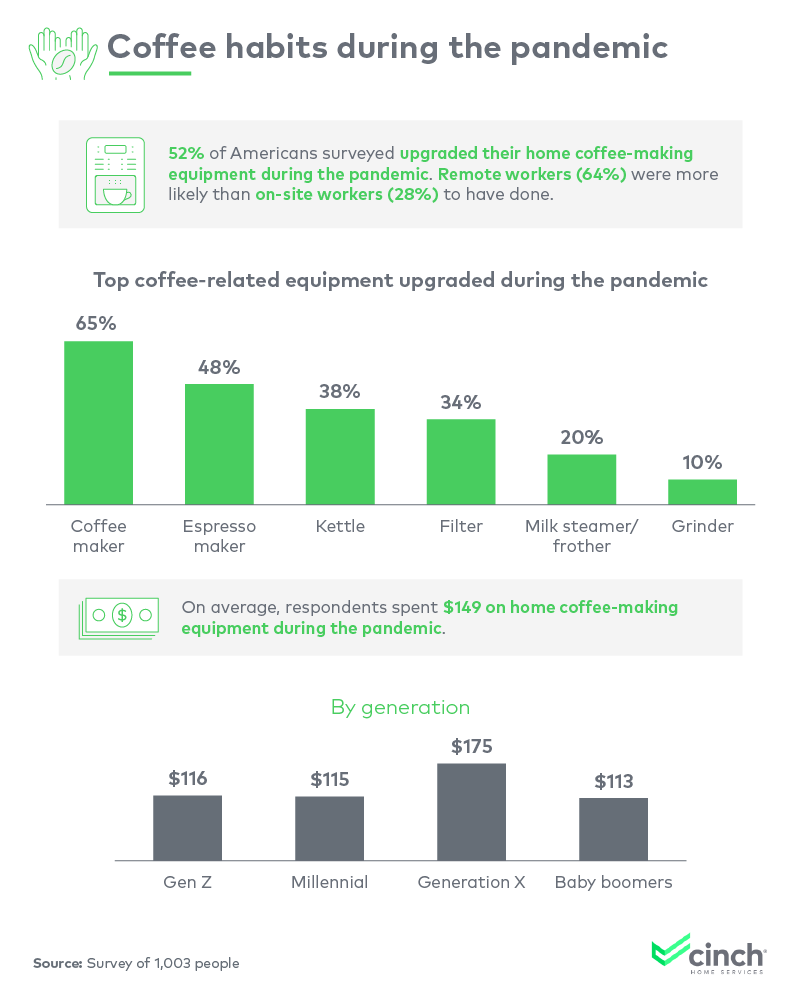

- More than half of Americans upgraded their coffee-making equipment during the pandemic

- 34% of Americans reported consuming more caffeinated beverages during the pandemic than in previous years

My coffee, my life

The traditional cup of Joe has evolved more than you might think, with each generation spending more on their caffeine fix and assigning it greater importance in their lives. So what does coffee in America look like these days?

After speaking to more than 1,000 American coffee drinkers about their daily coffee habits, we noticed a few interesting things, including some significant generational divides with regard to consumption. We also analyzed spending, top brands, and even the emotional importance of coffee for each participant. To see what we found and how your relationship with coffee measures up, keep reading.

Crucial coffee

Let's take a look at the importance of that morning caffeine jolt. We compared answers by generation, then explored how many cups people were actually drinking.

Gen Zers placed greater importance on coffee than any other generation, with 80% ranking coffee as highly important to their day. Perhaps this is due to social media exposure: for example, the social platform TikTok has seen several DIY coffee recipes go viral, and regularly features to-go coffee as an accessory on well-followed fashion pages. Overall, at least 67% of people across all other generations agreed that coffee was highly important to their day.

While coffee and espresso were still the most popular ways to consume caffeine, Gen Zers seem to also be fueling the energy drink market, with 64% getting their caffeine this way. While "energy drink" is a broad term, studies show they are generally poor for your health.

The average respondent drank three full cups of coffee daily, with the potential for even greater consumption if they were working remotely. In fact, one in five respondents said they drank five or more cups daily. For 67%, the first cup of coffee is a necessary morning boost, with an additional 28% saying it helps them to be more productive.

Particular preferences for coffee

With so many options to choose from, coffee preferences can be as varied as people's personalities.

Most people preferred traditional coffee to decaffeinated options. This was especially true for Gen Xers: Born between the mid-1960s and early 1980s, 68% of this generation wanted caffeine in their coffee, compared to just 53% of Gen Zers. Iced coffee was particularly unpopular amongst baby boomers, although more than a third of all other generations enjoyed it cold.

We found political affiliation to have a significant effect on respondents' coffee brand of choice. While Starbucks was the most popular brand for both parties, Democrats were particularly fond of it. Republicans were more likely to opt for Dunkin' than Democrats, who also demonstrated an affinity for The Coffee Bean & Tea Leaf. Starbucks and The Coffee Bean originated in Seattle and Los Angeles, respectively —both of which are very left-leaning cities.

The cost of caffeine

Of course, this daily (or even thrice daily!) habit isn't free. We asked respondents to share how much they spend on coffee each week, then filtered the results by generation, brand, and industry.

Gen Z spends the most on coffee, averaging $31 per week, and were more than twice as likely to prefer "gourmet" coffee than older generations. Perhaps this is why experts believe this generation is redefining the coffee sector: They're putting their dollars behind it, to the tune of $150 billion worth of spending power in the US alone. Millennials weren't far behind, spending $30 per week on average.

While Starbucks is viewed to be notoriously expensive by many, it was not the most costly brand in terms of overall spending. Instead, respondents spent more at Tim Hortons, The Coffee Bean & Tea Leaf, and Peet's. Dunkin' was the only popular brand to break a significant cost barrier, with a weekly coffee expenditure below $20.

One in four respondents said they would spend less on coffee specifically because of rising prices, although many were willing to pay whatever it costs. Eighteen percent said they wouldn't change their behavior at all in spite of rising prices, while people in business and information industries had already upped their spending to $34 per week.

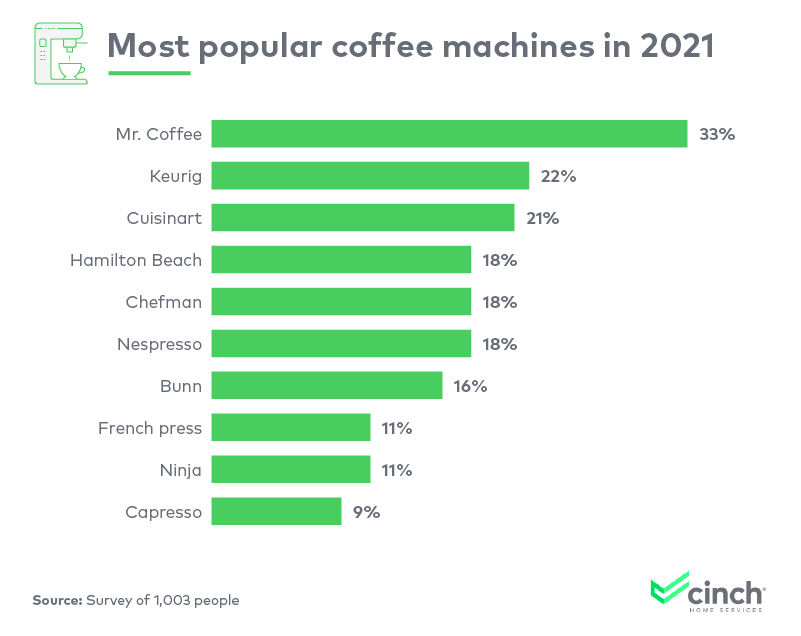

When it comes to making coffee at home, Mr. Coffee was the most popular brand –by far. One-third of respondents chose this type of machine for their at-home coffee needs. Keurig took second place, with 22% of respondents favoring this luxe option. Keurig machines start at $60 but can cost upwards of $250, not to mention the daunting per-cup price or the environmental repercussions of requiring a single-use plastic K-Cup for each serving.

Coffee in a time of COVID

Many people changed their coffee habits when the pandemic struck. With local shops closed and budgets squeezed, coffee lovers reacted accordingly.

With people spending so much time in their houses, the home improvement industry saw a notable boom early on in the pandemic. The DIY coffee experience also received a similar boost: More than half of our respondents upgraded their personal coffee-making equipment, with 65% purchasing a brand new coffee machine. One in five went the extra mile and brought home a milk frother, and 10% even invested in a grinder to have cafe-fresh grounds at home.

While Gen Z spent the most on coffee in general, Gen X spent the most on equipment for making coffee at home. They dished out $175 on average during the pandemic, compared to baby boomers and millennials who spent just $113 and $115, respectively. Gen Zers spent $116 on average. Given Gen Z's $31 weekly budget for store-bought coffee, if they used the $116 to purchase a DIY coffee machine, it could pay for itself in under a month!

Coffee as part of your home

Coffee was an integral part of life for most respondents. They reported drinking an average of three cups per day, and were often willing to pay for it no matter the cost. Younger respondents were especially keen on in-store coffee spending, although the pandemic appeared to have inspired respondents across generations to upgrade their at-home coffee-making experience.

If you're looking to improve your quality of life at home, whether coffee-related or otherwise, you'll want to protect your new purchases. Cinch Home Services offers comprehensive and affordable protection plans for all of your appliances. From refrigerators and dryers to built-in systems like heaters, your investments remain covered and ready to use with Cinch.

Methodology and limitations

We surveyed 1,003 respondents ranging in age from 23 to 64 in order to explore their preferences regarding coffee and other caffeinated beverages. The mean age was 40. Among them, 57% were men and 43% were women.

The sample sizes for each generation were as follows:

- Generation Z: 131

- Millennials: 354

- Generation X: 354

- Baby boomers: 153

- Others: 11

For short, open-ended questions, outliers were removed.

To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

These data rely on self-reporting by the respondents and are only exploratory. Issues with self-reported responses include but aren't limited to exaggeration, selective memory, telescoping, attribution and bias. All values are based on estimation.

Fair use statement

Feeling energized just thinking about your next coffee? Feel free to share the buzz and the data in this article. Just be sure it is for noncommercial purposes only and that you link back to this page.